SWINGARM TRADING PLAN

Determine your risk tolerance:

Before making any trades, you need to determine how much you are willing to risk per trade. This will help you establish a maximum stop protection amount. Every trade setup must have a reward that justifies the risk taken. The risk/reward ratio measures the potential profit against the potential loss of a trade. To achieve a high probability of success, traders should only enter trades that have a favorable risk/reward ratio, typically 4:1 or greater. This means that the potential profit should be at least four times the potential loss of the trade. By using risk/reward analysis, traders can manage their risk effectively and maximize their profits.

Calculate position size:

Once you have established your maximum stop protection amount, you can calculate your position size. This will depend on the price of the security, your risk tolerance, and your trading account balance. (New Trader Average Account Size $30,000). DO NOT RISK MORE THAN 1% IN ANY ONE TRADE

Implement stop protection:

Once you have determined your position size, you can implement your stop protection. With the swingarm pressure system, you have the ability to customize your stop protection and use it as a trailing stop protection to protect your profits.

Establish a daily stop-loss budget by setting a maximum amount of funds to allocate for stops. For instance, setting a limit of $1200 for the day would allow for up to four trades in the session. If all four trades are stopped, the maximum loss for the day would be $1200. Example: 1 ES Contract and 6 Point Stop. $300 Max loss per trade.

$30,000 X 1% (RISK % PER TRADE) = $300

= $1200 MAXIMUM POTENTIAL COST TO OPERATE YOUR TRADING BUSINESS PER DAY.

= $480 MAXIMUM POTENTIAL COST TO OPERATE YOUR TRADING BUSINESS PER DAY.

Maximum allowance for losses in one day:

If trading 1 ES Contract, the maximum allowable loss for the worst day should be -$1200 or less.

If trading 1 MES Contract, the maximum allowable loss for the worst day should be ---- Qty 1 = -$120 or less. If Qty = 4 - $480.00 ----

If your account is really small, start small and grow from there. Just be patient and study.

OPTIMAL TRADE ENTRY LOCATION:

Traders have multiple ways to enter a trade when using the SwingArm Pressure System. These include:

Cease trading for the day if a trader exhausts their allowable 4 trades and all 4 end up with stop losses.

Key Steps in Successful Trading

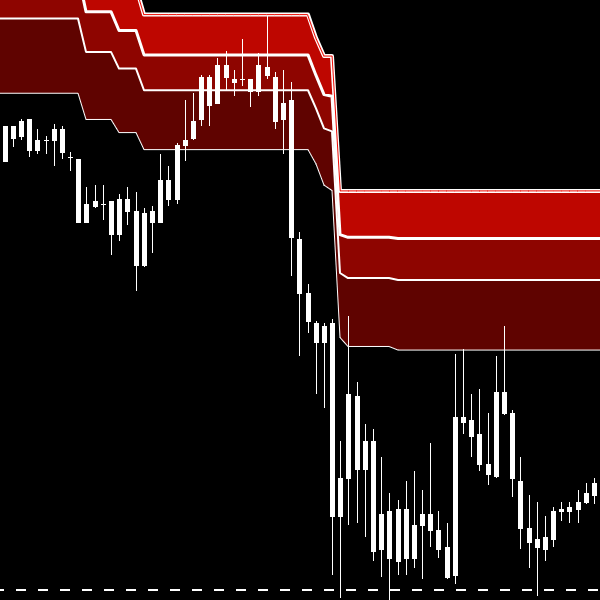

Entering the freshly created Swingarm buy or sell bucket zones (Bearish / Bullish Setups)

Entering at the freshly created High Pressure Swingarm buy or sell bucket zones

Entering at Optimal Entry Boxes

Using trendline pressure signals to enter a trade.

Entering at extreme buy or sell signals, particularly when in agreement with higher timeframe areas of interest or when combined with trendline pressure signals.

Set profit targets:

Monitor and adjust:

Adjust the stop as the price moves in your favor:

Repeat with consistence

Taking profits

SwingArm System Slide Show

“Trading with the SwingArm Pressure System – the simple yet effective way to consistent profits. Identify major opportunities, manage risk, and focus on rewards. Start with the 2-day chart, use color-coded zones for entry, place stop based on risk, adjust stop as price moves, and take profits. Follow this process consistently and grow your account beyond your expectations #SwingArmPressureSystem #TradingSuccess”

“Take Control of Your Trading Emotions: Join SwingArm Education Group and Start to Achieve Consistent Profits”

Jose Azcarate Tweet

Join the High-Pressure Swingarm Education Group now and become a true expert in your field!

Unlock Your Trading Potential

Click to Sign up today and start making a real difference in your career