Visual / Color Coded Alert System, That Allows A Futures Trader To See An Upcoming“ Significant Market Move” Prior To The Event Occurring.

Learn to read price action using the High Pressure SwingArm

The swingarm high pressure system is a valuable tool for traders seeking to enhance their results and attain profitability. By implementing this system, traders can calm the emotional disturbances that often impede their performance, enabling them to make more informed and strategic decisions. The swingarm high pressure system helps traders to stay calm and focused even in high-pressure situations, reducing the likelihood of impulsive or emotional trades that can negatively impact their outcomes. With its ability to boost results and foster a more stable and level-headed approach to trading, the swingarm high pressure system is a must-have for anyone looking to achieve success and stability in the markets.

Lessons

The Benefits of the Free (Reg. SwingArm) and SwingArm High Pressure System (Included with Coaching Program)

The SwingArm

SwingArm Terms

Understanding Internal and External SwingArms

Timing The Trades

Introduction to SwingArm High Pressure Basics

Specific Settings of the High Pressure SwingArm

Introduction To High Pressure SwingArm Probabilities

High Pressure Bullish or Bearish SwingArms

High Pressure Bullish or Bearish Optimal Boxes and Entries

High Pressure Intersecting Trendlines

SwingArm Price Waves

Trading The Trend with SwingArms

How to avoid trades that go against you?

The "Trader's Scared Money Syndrome"

Dealing with Emotions: Fear, Greed, Anxiety, or Fear of missing out.

Improving Your Trading Psychology with Mindvalley

The Benefits of the Free (Reg. SwingArm) and SwingArm High Pressure System (Included with Coaching Program)

The SwingArm Trading System is a tool used by traders to help understand and visualize areas of interest for price movements in the market.

At its core, it’s all about identifying trends in buying and selling pressure – or in other words, supply and demand.

The idea is that supply and demand in the market create energy that can push the price of a stock, currency, or other investment up or down. By watching for changes in this energy, traders can get clues about where the price might be heading next.

When you see more buying pressure (demand) than selling pressure (supply), prices usually rise, and when there’s more selling pressure than buying, prices usually fall. The SwingArm system helps to show these shifts in supply and demand visually, making it easier to see the trend.

Traders can benefit from using the SwingArm system in several ways. First, it can help them identify potential buy and sell zones based on shifts in the trend. Second, it can offer a sense of what might be happening in the wider market, including how news events and other external factors might be affecting supply and demand.

Another significant advantage of the SwingArm system is that it can help traders manage their emotions. Trading can be a stressful activity, with lots of ups and downs. The SwingArm system gives traders a structured way to approach their decision-making, which can help keep emotions like fear and greed in check.

Lastly, the SwingArm system provides insights into nested SwingArms and SwingArm pairs. In essence, these are patterns that show how trends are behaving across different timeframes. By understanding these patterns, traders can make more informed decisions about when to enter or exit a trade.

Remember, the SwingArm system is a tool, and like all tools, it’s most effective when used correctly. Traders should always consider their individual risk tolerance and investment goals before making any trading decisions.

As a seasoned trader, you understand the value of having access to the right trading tools.

That’s why I am proud to offer the basic SwingArm completely free of charge on platforms such as ThinkOrSwim, NinjaTrader, TastyWorks, OneRealTime, Tradovate, and others. and SwingArm High Pressure System is available to traders worldwide exclusively on Tradingview.

My motivation for providing free access to the basic SwingArm is to ensure traders can experience its power and value firsthand. However, the complete set of tools—including the automation for the High Pressure System, High Pressure Trendlines, Pressure Levels, Extreme Support and Resistance indicators, and advanced strategies—is available through a one-time lifetime access fee of $199. This package includes initial education to help traders set up and utilize the system effectively. Given the strength of the High Pressure System, I am confident that traders will quickly recognize the immense value it provides in navigating the markets successfully.

Aside from the technical benefits of the SwingArm and High Pressure System, they can also help improve your trading mindset and performance. By providing clear and concise information about market trends, these tools enable you to make informed and confident trades, reducing stress and anxiety, and enhancing your overall trading experience.

In summary, the SwingArm and SwingArm High Pressure System are powerful tools that can help traders achieve success in the markets. My aim in offering them for free with a minimal annual fee for setup, upgrades, and education is to empower traders worldwide to reach their full potential.

To get access to the latest version of the swingarm (Free), follow me on TradingView and request access.

The SwingArm

Introduction to The SwingArm

As I delved into the world of technical analysis, I became aware of the series of steps I was taking on a daily basis to evaluate price behavior and make predictions about potential moves. I would utilize the Fibonacci retracements and extensions, along with the average true range of price (ATR) to gauge market range. However, as time went by, I realized that these labor-intensive analyses needed to be streamlined in order to speed up my process and minimize the risk of errors. This realization led to the development of the Swingarm indicator.

The Swingarm indicator is created to display three areas for buyers and three areas for sellers. As the price progresses deeper into the newly formed Swingarm zones, the likelihood of a potential price response in the opposite direction increases. The default settings for all time frames consist of an ATR period of 28 and an ATR factor of 5. However, there may be instances where I opt to raise the ATR to 9, and the rationale behind this decision will be discussed at a later time.

The Swingarm indicator offers a variety of options for traders. These include customizable labels such as “breakup” or “breakdown” labels, as well as labels for each of the zones indicating bullish or bearish direction. The indicator also features alerts that can be set to trigger during specific times, such as the US session, and highlights important periods of the day where volatility may change, such as during news events or market open and close times. The Swingarm introduces the use of RSI, highlighted in blue to indicate the potential exhaustion of a downward move and in red to indicate the exhaustion of an upward move.

In addition, the indicator displays a horizontal line labeled “stop loss,” which marks the ideal location to place a stop loss order. As the price moves in the intended direction, the stop loss marker adjusts accordingly, allowing the trader to protect profits and minimize risk in the event of a potential setup failure. The stop loss marker can be manually adjusted to reflect the trader’s risk tolerance.

The Swingarm is also a multi-timeframe indicator, giving traders the flexibility to view price action on a 1-minute timeframe while also examining areas of interest on higher timeframes such as the monthly chart. The settings of the Swingarm are highly customizable, with a multitude of options that can be turned on or off depending on the trader’s preferences.

SwingArm Terms

KEY TERMS TO UNDERSTAND IN THE SWINGARM TRADING SYSTEM / INDICATOR

STUDY TREND SHIFT

This is just a simple way to show when a trend changes direction, either upwards or downwards.

BUY / SELL ZONES

Think of these as “zones” that the SwingArm system shows us. These zones suggest good spots to test your buy or sell strategy when a trend changes direction.

VALUE ZONES

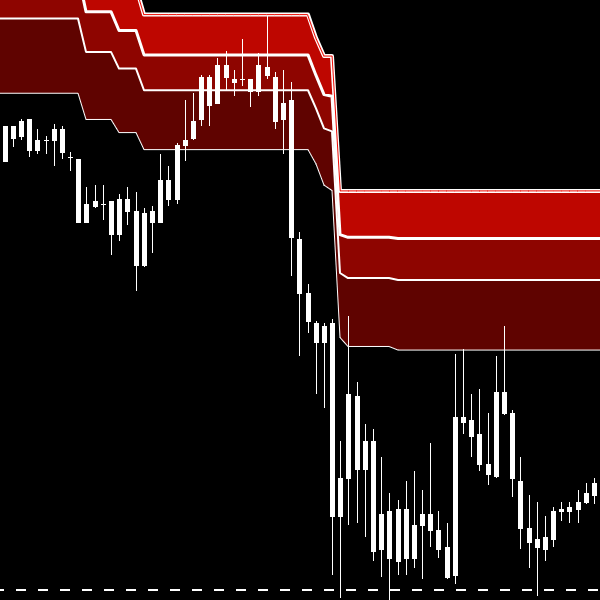

The SwingArm system uses colors to highlight zones where buying or selling may be a good idea. Three shades of green suggest good buy zones, and three shades of red suggest good sell zones.

SLINGSHOT

This term refers to how the price movement is driven by the power of buyers or sellers. Outside events, like news, can affect this. The SwingArm measures this effect (or impulse) and shows the value zones after a trend change.

NESTED SWINGARMS

This happens when prices keep moving in the same direction, letting multiple SwingArms fit inside each other. For instance, a 10-minute SwingArm could fit inside a 1-hour SwingArm if both are bullish.

SWINGARM PAIR

SwingArms work together when prices move in a trend. When prices are not trending, SwingArms pair up. The most recent big timeframe to change direction is one part of the pair, and the next timeframe in order is the other part.

SWINGARM INTERNALS AND EXTERNALS

Externals are the two biggest timeframes where price is moving within. Any lower timeframes inside these are called internal SwingArms. Price moves from a SwingArm squeeze when two or more SwingArms push in different directions. When price moves from the edges of the externals, the internal swingarms break on the way to backtest the large timeframe pair. An example of this is when price moves to the 4th Zone of the 8-hour timeframe, then turns to visit the Zones of the daily chart, and any lower timeframe in the range is an internal swingarm likely to break as backtesting occurs.

Understanding Internal and External SwingArms

Internal vs. External SwingArms and the energy they provide.

Swingarms operate in partnership with each other, sometimes moving in the same direction and at other times moving in opposite directions, creating a phenomenon referred to as a “squeeze.” Each Swingarm holds energy that can drive price in a particular direction. The higher the timeframe of the Swingarm, the more significant the energy for a potential response when price reaches its zones.

Grasping the concept of energy and potential momentum generated by a higher timeframe is critical for traders, as focusing solely on low-timeframe trends can lead to losses if price action reverses with significant energy due to its interaction with a high-timeframe zone, level, or area of interest.

Timing The Trades

The Importance of Timing in Trading: A Lesson on Maximizing Profits

In trading, timing is everything. A small miscalculation in the timing of entry, management, or exit can have a major impact on profitability and the trader’s mental state. Unfortunately, many retail traders overlook the significance of timing, leading to repeated errors and, in severe cases, total failure.

New traders often have a sense of urgency to enter trades, causing them to make hasty decisions and enter at the wrong times. They also tend to wait for confirmation of a move before considering an entry, which can result in missing out on better opportunities. Utilizing tools like the 4 hour high pressure swingarm can provide advance notice of potential price bounces and help guide better entry timing, as demonstrated on February 10, 2023.

To optimize my trades, I prefer to use a combination of traditional swingarms and high-pressure swingarms. I keep a close eye on the closest timeframe recently tested, such as the 2-month bounce from 3,500 on ES Futures, the weekly resistance, and possibly the 30-minute, all viewed on the 15-minute timeframe.

These higher timeframe swingarms give me the flexibility to set specific times of the day to highlight on the chart, such as news hours (8:00 to 8:30 AM) or a scheduled FED event (2:00 to 2:30 PM). Being aware of these times of increased volatility allows the trader to make informed decisions, such as adjusting stops, scaling out positions, or even exiting the trade.

It’s also important to note that volatility may increase from 3:30 to 4:00 PM, the end of the trading session for stock traders. By understanding the impact of timing and utilizing tools like the swingarm, traders can take their profits to the next level and achieve success in the world of trading.

Introduction to SwingArm High Pressure Basics

The High Pressure Swingarm is a cutting-edge tool that provides valuable insights into the pressure dynamics of a security’s price.

With its distinctive blue and yellow display, traders can easily identify the presence of bullish and bearish energy in the market. As the price trends, the indicator shifts to green for bullish setups and red for bearish setups, allowing traders to stay ahead of the curve and make informed decisions.

This comprehensive tool includes several key features, such as:

A High-Pressure SwingArm display with a clear representation of bullish and bearish price action.

Trending price action, depicted in green for bullish setups and red for bearish setups.

Optimal entry points for buying and selling.

High-Pressure Zones for bullish (Blue) and bearish (Yellow) setups.

Labels for critical zones, breakouts and breakdowns, and alerts for all.

High Pressure Intersecting Trendlines and Signals for additional clarity.

SwingArm Price Waves and signals to help traders stay on top of market trends.

Extreme Zone Signals, which alert traders to upcoming resistance or support levels and provide guidance on adjusting stops, scaling out, closing positions, and potentially trading in the opposite direction.

The High Pressure Swingarm is a powerful tool that can have a significant impact on a trader’s profitability. With its user-friendly design and comprehensive functionality, it’s an essential tool for anyone looking to take their trading to the next level.

Specific Settings of the High Pressure SwingArm

The SwingArm High-Pressure System offers a wide range of options to enhance your trading experience.

It calculates the probability of trend continuation for both regular and news days, taking into account the potential for increased volatility. The system also provides the flexibility to choose which swingarm timeframes to display, including 15-minute, 1-hour, 2-hour, and 4-hour options. You can customize your chart display by selecting pressure boxes for bullish and bearish setups, including optimal entry points for buying and selling. Every important piece of information on the charts is accompanied by an alert, ensuring that you never miss an opportunity to protect your profits or consider entering a new trade.

Introduction To High Pressure SwingArm Probabilities

“Unlock Your Trading Potential with the SwingArm High Pressure Indicator!

Get ahead of the game with the SwingArm High Pressure Indicator – the ultimate tool for traders seeking a competitive edge. With its powerful color coding system – blue for bullish and yellow for bearish setups – you’ll always know when to enter the market. The indicator also displays pressure zones and sends extreme pressure zone alerts, providing multiple ways to stay ahead of the game. With the SwingArm High Pressure Indicator, you’ll be able to enter trades early with a small stop, resulting in a great risk-reward ratio. Don’t miss out on this opportunity to improve your trading results.

Sign up now to get access to the SwingArm High Pressure Indicator on TradingView!”

High Pressure Bullish or Bearish SwingArms

“Maximize Your Trading Success with the SwingArm High Pressure System!

Technical analysis is essential for making informed trading decisions, but it’s not always easy to get it right. Bias, clouded judgement, and personal factors can all impact the accuracy of your analysis. That’s where the SwingArm High Pressure System comes in. This powerful tool objectively measures pressure using momentum, volume, trend, and other key metrics, eliminating the influence of hope, bias, and other personal factors. With the SwingArm High Pressure System, you’ll have a higher probability of success and profitability – all you need to do is follow the set of rules provided by the system. Say goodbye to flawed analysis and hello to smarter trading decisions with the SwingArm High Pressure System.”

High Pressure Bullish or Bearish Optimal Boxes and Entries

“Take the Guesswork Out of Trading with the SwingArm High Pressure System.

Technical analysis is a crucial aspect of trading, but it’s often clouded by personal biases, expectations, and emotions. The SwingArm High Pressure System removes these subjective factors by providing an objective calculation of market pressure based on momentum, volume, trend, and more. The result? A higher probability of success and profitability.

Easily spot market opportunities with the SwingArm High Pressure System’s color coding – blue for high pressure buying (bullish) and yellow for high pressure selling (bearish). The system also displays high pressure boxes, making it simple to see where the high-probability trades are. When the SwingArm High Pressure System is in agreement with the high pressure boxes, you know you’re in for a winning trade with huge energy in the direction it’s set up for.

Sign up now to start executing trades with confidence and precision.”

High Pressure Intersecting Trendlines

“Maximize Your Trading Success with the Comprehensive SwingArm High Pressure System.

The SwingArm High Pressure System is a suite of powerful tools designed to measure market pressure in multiple ways. From the SwingArm itself to the Pressure Boxes, Extreme Pressure Zones, Trendlines High Pressure Signals, and SwingArm Price Waves, you’ll have a full arsenal of analysis tools at your fingertips.

By analyzing price over time, the SwingArm High Pressure System provides you with valuable insights to help you make informed trading decisions. Say goodbye to guesswork and hello to consistent success with the comprehensive SwingArm High Pressure System.

Sign up now to start using these cutting-edge tools for your trading.”

SwingArm Price Waves

“Elevate Your Trading Skills with the SwingArm High Pressure System.

Moving averages have been a staple in technical analysis for decades, but the SwingArm High Pressure System takes it to the next level. This set of tools provides valuable information for day trading or swing trading, supplementing your overall trade analysis with guidance on entry, management, exit, and take profit options.

The key to success with the SwingArm High Pressure System is education and mindset. While we can provide support and guidance to help traders reach their full potential, the ultimate success depends on their own hard work and dedication. As one of my mentors once said, ‘Experience cannot be transferred or given, one must do the work to get it.’

Take your trading to the next level and start using the SwingArm High Pressure System to make informed and profitable trades.”

Trading The Trend with SwingArms

“Technical Analysis with SwingArms: Identifying Trends and Trading Zones.

The SwingArm system provides a clear and concise representation of market trends, with bearish trends indicated in red and bullish trends indicated in green. The use of the High Pressure SwingArm further enhances this analysis, with strong bullish trends represented in blue and bearish high pressure trends represented in yellow.

For optimal profitability, it is recommended to focus on trading with the trend, rather than targeting specific price points. When a target is reached, it is crucial to monitor the lower timeframes for potential shifts in market direction, providing opportunities for trades in the opposite direction.”

How to avoid trades that go against you?

There is no foolproof way to avoid having a trade go against you, as markets are inherently unpredictable. However, there are several steps you can take to minimize the risk of a trade going against you:

Have a well-defined trading plan: Before entering a trade, you should have a clear understanding of your entry and exit points, risk management rules, and trading objectives.

Manage your risk: Use stop-loss orders to limit your potential losses, and only risk an amount of capital that you are comfortable losing.

Stay disciplined: Stick to your trading plan, even if the market is not behaving as you expected. Don’t let emotions drive your trading decisions.

Monitor the market: Keep an eye on economic news and events that could impact your trade, and adjust your positions as needed.

Manage size: Keep control of your position size, and do not continue to increase size to a losing trade with the hope it will turn around. SwingArms provide a clear view that trend has changed by breaking down or up low timeframe swingarms.

Learn from your mistakes: If a trade goes against you, reflect on what you could have done differently, and use that information to improve your future trades.

By following these steps, you can reduce the risk of a trade going against you and increase the chances of success in the long run.

The "Trader's Scared Money Syndrome"

The “Trader’s Scared Money Syndrome” refers to a common fear that many traders experience when they are afraid to take a trade, due to the potential loss of money.

This can cause traders to miss out on potential profits and limit their success in the markets.

To overcome this syndrome, traders need to focus on developing a solid trading plan and strategy. This should include identifying their risk tolerance, setting realistic goals, and having a well-defined exit strategy for both winning and losing trades. Additionally, it is important for traders to manage their emotions and avoid over-analyzing market conditions.

The SwingArm High Pressure System can greatly improve a trader’s outcomes by providing clear and concise information about market trends. The system offers a visual representation of bullish or bearish trends and high pressure zones, allowing traders to make informed decisions based on the current market conditions. Additionally, the system can help traders identify key entry and exit points, providing them with the confidence they need to take trades without fear of losing money.

Overall, the SwingArm High Pressure System can help traders overcome the “Trader’s Scared Money Syndrome” by providing them with the tools they need to make informed and confident trades.

Dealing with Emotions: Fear, Greed, Anxiety, or Fear of missing out.

Overcoming Emotional Issues in Trading with the SwingArm High Pressure System

As a trader, it is natural to experience emotions such as fear, greed, anxiety, and the fear of missing out when trading. However, these emotions can have a negative impact on your trading performance, leading to poor decision-making and missed opportunities.

To overcome these emotional issues, it is important to develop a solid trading plan that includes clear entry and exit points, a well-defined risk management strategy, and a focus on long-term results rather than short-term gains. In addition, traders can also benefit from practicing mindfulness and stress management techniques to reduce anxiety and manage their emotions effectively.

The SwingArm High Pressure System can also help traders address these emotional issues by providing clear and concise information about market trends. The system offers a visual representation of bullish or bearish trends and high pressure zones, allowing traders to make informed decisions based on the current market conditions. Additionally, the system can help traders identify key entry and exit points, providing them with the confidence they need to take trades without fear of losing money.

By incorporating the SwingArm High Pressure System into their trading plan, traders can improve their performance by reducing anxiety, managing their emotions, and making more informed and confident trades. With the right tools and a solid trading plan, traders can overcome the emotional challenges that often arise in the markets and achieve long-term success.

Improving Your Trading Psychology with Mindvalley

As a trader, it is important to understand that your mindset and emotional well-being can have a significant impact on your trading performance.

If you are experiencing mind challenges, such as anxiety, stress, or fear, it is essential to seek help.

There are many resources available to traders looking for psychological support, including therapists, support groups, and online communities. However, for those seeking a more comprehensive approach to trading psychology, Mindvalley.com can be a great asset in your toolkit.

Mindvalley.com is a leading online learning platform that offers a variety of courses and programs designed to help traders improve their mental and emotional well-being. The platform offers courses on topics such as mindfulness, stress management, and personal development, all of which can be beneficial to traders looking to improve their mindset and performance.

In addition to its wide range of courses, Mindvalley.com also offers a supportive community of like-minded individuals who are all working towards similar goals. This community can provide valuable support, encouragement, and motivation, helping traders to stay on track and achieve their goals.

In conclusion, traders who are experiencing mind challenges can benefit from seeking psychological help from resources such as Mindvalley.com. With its comprehensive approach to trading psychology and supportive community, Mindvalley.com can be a valuable asset in your set of tools, helping you to improve your mindset, manage stress, and achieve long-term success in the markets.

The blackFLAG© Futures Trading System addresses the two most critical decisions a trader makes - Trade Entry & Exit.

Dramatically Improve Trading Performance with The blackFLAG© Futures Trading Alerts.