🎯 SwingArm PressureShift Strategy v8 – Core Features Summary

📊 Core Trading Logic

- Multi-Timeframe Pressure Analysis: Compares 15-minute and 30-second pressure to identify agreement

- Pressure Streak Confirmation: Requires consecutive bars of same pressure direction (default: 3 bars)

- Heiken Ashi Support: Toggle between regular candles and Heiken Ashi for smoother trend analysis

- Directional Trading: Both directions, bullish only, or bearish only modes

🛡️ Risk Management Systems

Pressure Validation Stop-Loss

- 4 Sensitivity Levels: Conservative (15 ticks), Moderate (25 ticks), Aggressive (40 ticks), Custom (5-100 ticks)

- Smart Re-qualification: Closes failed trades, waits, then re-enters if pressure persists

- Configurable Validation Period: 1-10 bars to monitor after entry

News Event Protection

- Major Economic Events: Employment, FOMC, CPI, PPI, Retail Sales, Fed Speeches, OPEX

- Automatic Trading Suspension: Configurable buffer time (5-60 minutes) around news events

- Visual Warnings: Color-coded backgrounds and alerts for high-risk periods

CHOP Detection

🎯 Advanced CHOP Detection System Implemented!

🔧 New Interface Features (Organized in “CHOP Detection” Group):

🎚️ Primary Controls:

- Enable Advanced CHOP Detection ✅ (new default)

- CHOP Detection Sensitivity: Conservative/Moderate/Aggressive dropdown

- Show CHOP Background ✅ (purple background during chop)

- Show CHOP Labels ✅ (detailed chop analysis labels)

🎨 Visual Options:

- CHOP Background Color: Customizable (default: purple)

- Show CHOP Metrics ⚪ (optional technical metrics display)

⚙️ Advanced Parameters:

- ATR Length: 14 (volatility analysis)

- Trend Strength Period: 20 (momentum analysis)

- Range Compression Threshold: 0.6 (pattern detection)

🔄 Legacy Compatibility:

- Enable Legacy CHOP Detection ⚪ (preserved original method)

🧠 Multi-Layer Analysis:

1. Volatility Analysis:

- ATR expansion/contraction ratios

- Dynamic volatility thresholds

2. Trend Strength (ADX-style):

- Directional movement analysis

- Momentum consistency measurement

3. Range Compression:

- Inside bars and narrow ranges

- Failed breakout detection

4. Pattern Recognition:

- Support/resistance ping-pong

- Price action consolidation patterns

📊 Sensitivity Levels:

- Conservative: Filters only obvious chop (fewer trades blocked)

- Moderate: Balanced filtering (recommended)

- Aggressive: Maximum chop avoidance (more trades blocked)

🎯 Visual Feedback:

- Purple background during detected chop periods

- Detailed labels showing why chop was detected

- “CHOP CLEARED” notifications when trading resumes

- Optional metrics display for technical analysis

🚨 TraderPost Integration:

- CHOP Detected alerts with sensitivity level

- CHOP Cleared alerts for trade resumption

- Enhanced trade quality through better filtering

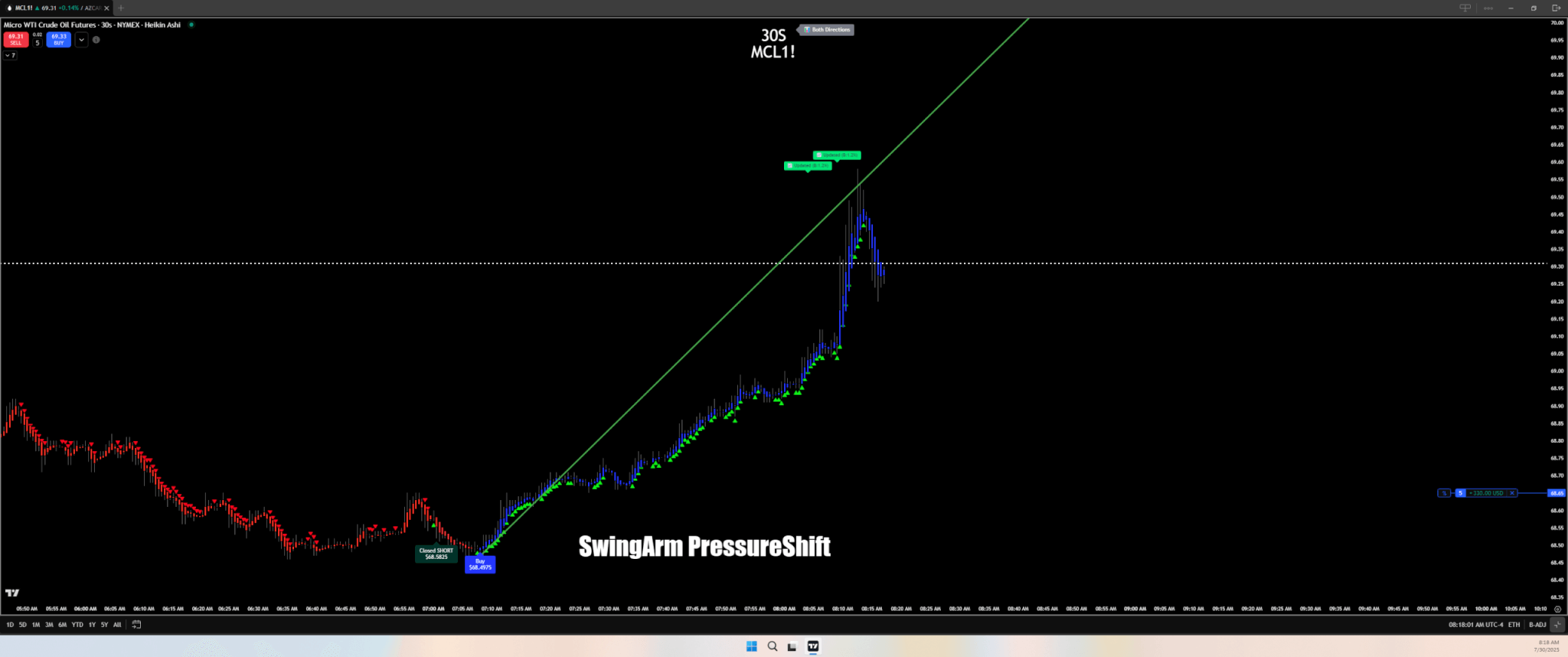

This should dramatically reduce those whipsaw trades you were seeing in the choppy middle section of your chart! The system will now analyze multiple dimensions of market behavior to identify true directional opportunities vs. noise. 🚀

⏰ Session Management

- Dual Time Blocks: Two configurable trading windows with EST timezone support

- Blocked Trading Windows: User-defined periods to avoid trading (default: 3:40-6:05 PM EST)

- Session-Based Volatility: Auto-adjusting parameters for Asian, European, and US sessions

📈 Advanced Position Management

Trendline Profit Management

- Auto-Calibrating Trendlines: Dynamic adjustment based on volatility and session

- Smart Profit Taking: Follows trend momentum with configurable break buffers

- Visual Confirmation: Real-time trendline display with performance metrics

Front Month Contract Trading

- Automatic Contract Selection: Always trades the most liquid front month contract (ES1!, CL1!, etc.)

- Seamless Rollover: No manual contract switching required

🎨 Visual System

- Pressure Labels: “B%” indicators showing buying/selling pressure strength

- Signal Triangles: Customizable entry signals with offset positioning

- Trade Labels: Entry/exit labels with quantity and price information

- Color-Coded Candles: Visual pressure indication on price bars

🔧 Automation Features

- TraderPost Integration: Full compatibility for automated trading

- Comprehensive Alerts: Entry, exit, news events, and validation stops

- Order Size Display: Configurable quantity labels for position tracking

- Multiple Exit Reasons: Pressure shift, trendline break, news events, validation stops

📋 Key Settings

- Entry Delay: 3 bars wait before re-entry (prevents over-trading)

- Pressure Confirmation: 3 bars required for signal validation

- News Buffer: 15 minutes default protection around major events

- Order Size: Configurable display for trade labels

- Triangle Offset: Positioning control to avoid candle overlap

🚀 Performance Optimizations

- Historical Buffer Management: Fixed buffer issues for reliable backtesting

- Session-Aware Calibration: Automatic parameter adjustment for market conditions

- Multi-Layer Confirmation: Pressure agreement + streak + CHOP + news filtering

- Quality Over Quantity: Fewer, higher-conviction trades for better automation

Perfect for: Automated futures trading, swing trading, pressure-based strategies, risk-conscious traders seeking systematic edge identification with comprehensive protection systems.

Trendline Profit Taking

Interactive Features:

Market Scenarios:

🔸 Strong Trending Market – Tight trendlines, quick updates

🔸 Choppy/Volatile Market – Loose trendlines, slower updates

🔸 Asian Session – Higher volatility adjustments

🔸 US Session – Standard liquidity settings

🔸 Random Scenario – Generate new market conditions

Visual Elements:

✅ Blue Line – Price action

✅ Green/Red Dashed Lines – Dynamic trendlines

✅ Orange Dashed Line – Break threshold (profit-taking level)

✅ Pink Dot – Actual profit exit point

Real-time Stats:

📊 Market Volatility – Shows current market conditions

📊 Auto Break Buffer % – Dynamic profit-taking sensitivity

📊 Auto Update Bars – How often trendlines redraw

📊 Exit Trigger Bar – When profit was taken

Controls:

⚙️ Toggle Auto-Calibration – Compare auto vs manual settings

⚙️ Manual Overrides – Test fixed parameters

⚙️ Position Type – Switch between long/short scenarios

What You’ll See:

- Tight settings in trending markets (small break buffer)

- Loose settings in volatile markets (large break buffer)

- Session-based adjustments (Asian vs US behavior)

- Exact exit points where profits would be taken

🎯 Trendline Profit-Taking Strategy Demo

Visualize how the auto-calibrating trendline system adapts to different market conditions

🎯 SwingArm PressureShift Strategy - Trendline Profit Management Demo

This tool helps visualize how auto-calibration adjusts trendline sensitivity based on market conditions

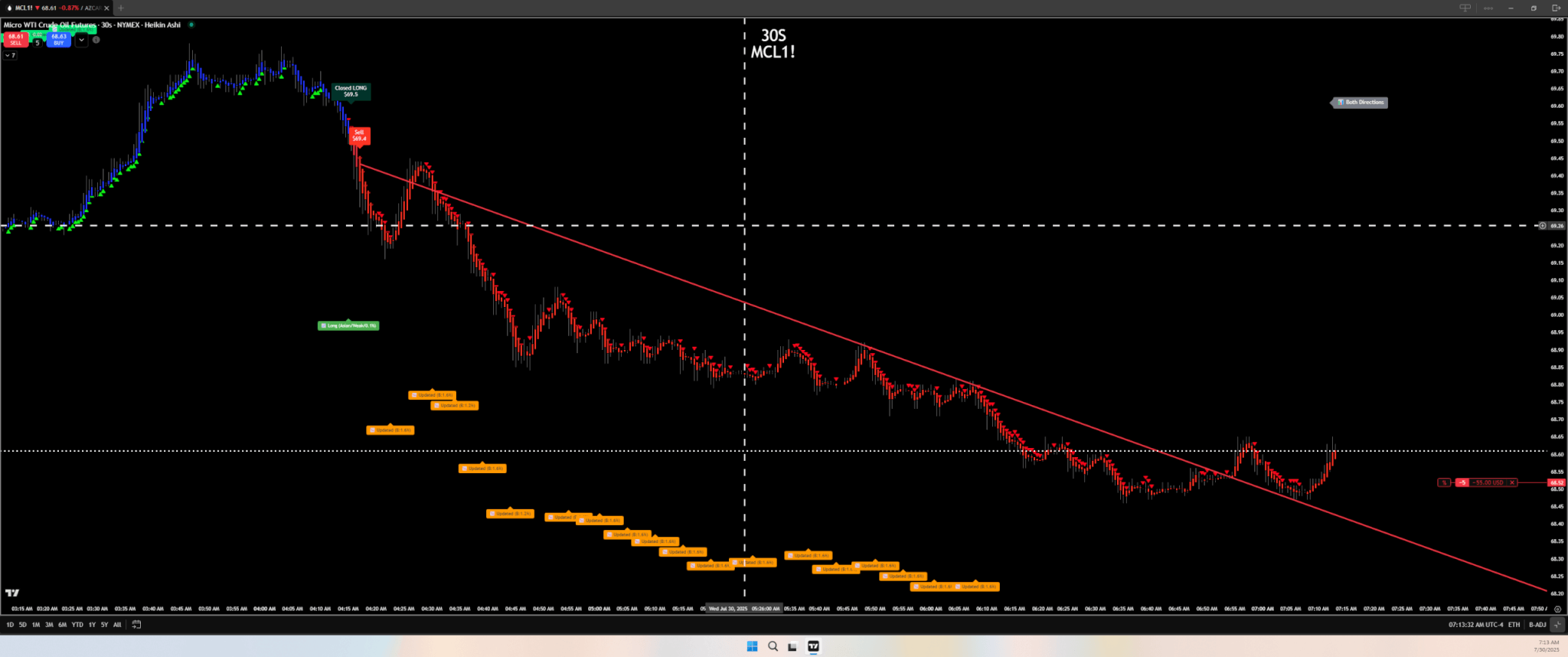

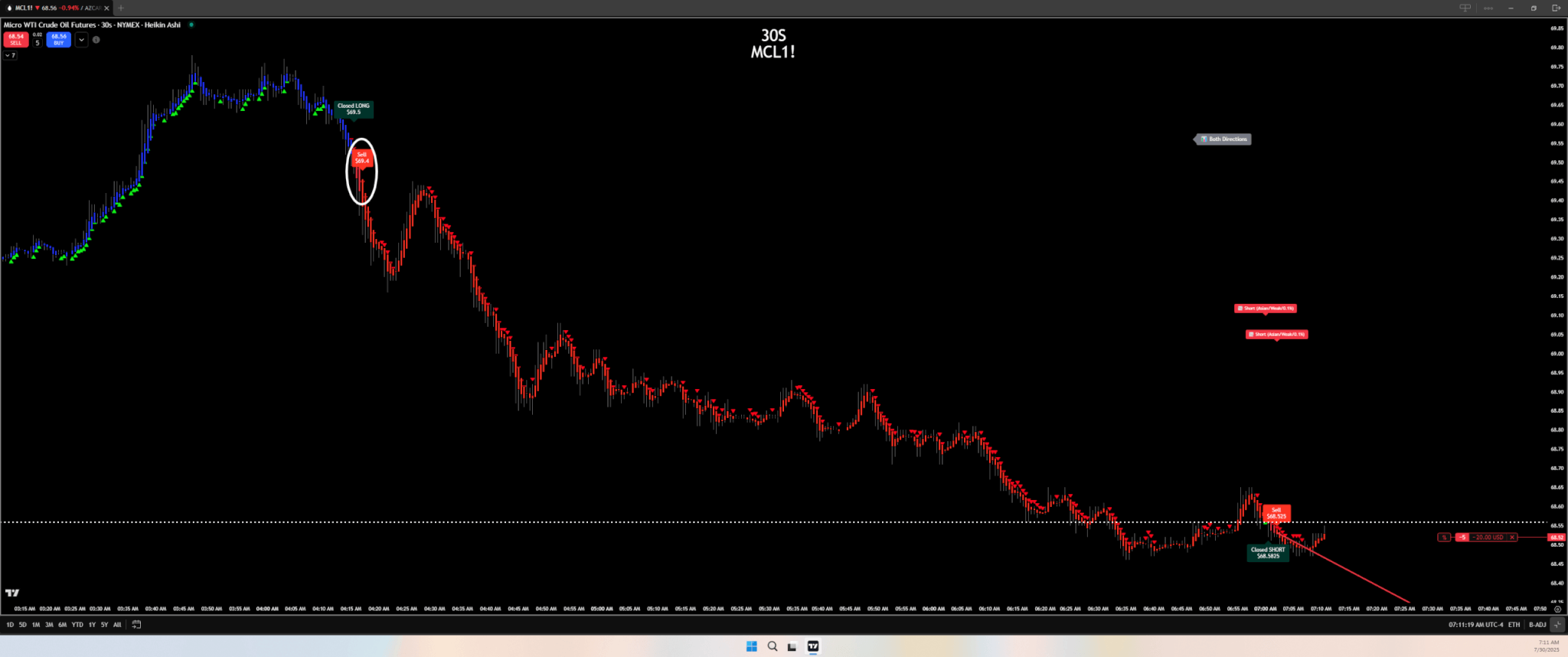

Oil - Short Illustration

🔍 Signal Validation & Trade Management Breakdown

📉 Sell Signal Confirmation:

The red “SELL” signal was triggered precisely at the swing high near a key resistance zone. Price action confirmed a classic shift from buying to selling pressure at that level, and the ensuing drop validates the timing and accuracy of the signal.

📈 Trendline Profit-Taking Update:

In Image 2, a dynamic red trendline overlays the chart, acting as the reference for profit-taking. Orange profit-taking levels adjust in real-time, aligning with price movement and clearly marking staged exit zones. The strategy effectively identifies support levels for planned exits.

🖥️ Chart Display Functionality:

Both history modes (on/off) are functioning as intended, showing entry signals, pressure shifts, and trendline-based exit targets. Signal clarity, timing, and consistency are well-suited for swing trading execution.

✅ Key Takeaway:

The early morning short on oil highlights strong confluence between our pressure shift analysis and conventional technical resistance. The trendline-based exit system updates dynamically and provides a clear, structured path for managing profits.

Advanced Profit Management System

🎯 What’s New in Your Strategy

Multi-Target Take Profit System

- Enters with 3+ contracts (configurable from 2-10)

- Takes partial profits at TP1, TP2, TP3

- Lets remainder run until pressure shifts or trailing stop hits

- Smart trailing stop for maximum profit extraction

Key Features Added:

- Flexible Target Calculation: Choose percentage-based OR ATR-based targets

- Visual Take Profit Lines: See your targets on the chart

- Real-time Position Tracking: Know exactly what’s happening

- Enhanced Pressure Detection: Better exit timing for remainder

- Comprehensive Alerts: Get notified at every profit level

⚙️ Recommended Settings to Start

For Micro Contracts (MNQ, MES, etc.):

- Base Entry Quantity: 3

- TP1: 0.6%, TP2: 1.2%, TP3: 2.0%

- TP Quantities: 1, 1, 1 (leaves 0 remainder for pressure exit)

For Standard Contracts (ES, NQ, etc.):

- Base Entry Quantity: 3

- TP1: 0.8%, TP2: 1.6%, TP3: 2.5%

- TP Quantities: 1, 1, 1

🎮 How It Works

- Entry: Your pressure system triggers → Enters with 3 contracts

- TP1 Hit: Takes profit on 1 contract at 0.8% gain

- TP2 Hit: Takes profit on 1 contract at 1.6% gain

- TP3 Hit: Takes profit on 1 contract at 2.5% gain

- Remainder: Uses trailing stop + pressure shift detection for final exit

📊 New Visual Elements

- Yellow dashed line: TP1 target

- Orange dashed line: TP2 target

- Red dashed line: TP3 target

- Blue info box: Live position status

- Green checkmarks: TP hit confirmations

🚨 Important Notes

- Your original strategy is preserved – just turn off “Enable Multi-Target” to use the old way

- Default quantity changed to 3 in strategy properties (you can adjust this)

🔧 Fine-Tuning Tips

If you want more conservative:

- Lower the TP percentages (0.5%, 1.0%, 1.5%)

- Use ATR-based targets with smaller multipliers

If you want more aggressive:

- Higher base quantity (4-5 contracts)

- Take fewer contracts at early TPs, leave more for runners

The beauty of this system is that it captures profits on the way up while still letting you ride the big moves with your pressure-based exits!

Defaults to Trade Bitcoin Automation

Bitcoin-Specific Considerations:

- Volatility: Bitcoin moves fast – your 0.8%/1.6%/2.5% targets might hit quickly

- Weekend Action: Crypto trades 24/7, so you’ll get continuous data

- Momentum: Bitcoin tends to have strong directional moves – perfect for your pressure system

⚙️ Suggested Settings for Bitcoin Testing

Conservative Start (Recommended):

- Base Quantity: 3

- TP1: 0.6%, TP2: 1.2%, TP3: 2.0%

- TP Quantities: 1, 1, 1 (leaves 0 for pressure-based exit)

If Bitcoin is Moving Strongly:

- Consider ATR-based targets instead of percentages

- ATR Multipliers: 1.2x, 2.0x, 3.5x