This phenomenon is tied to market structure and liquidity cycles:

🧠 Key Reasons:

Liquidity Anchoring

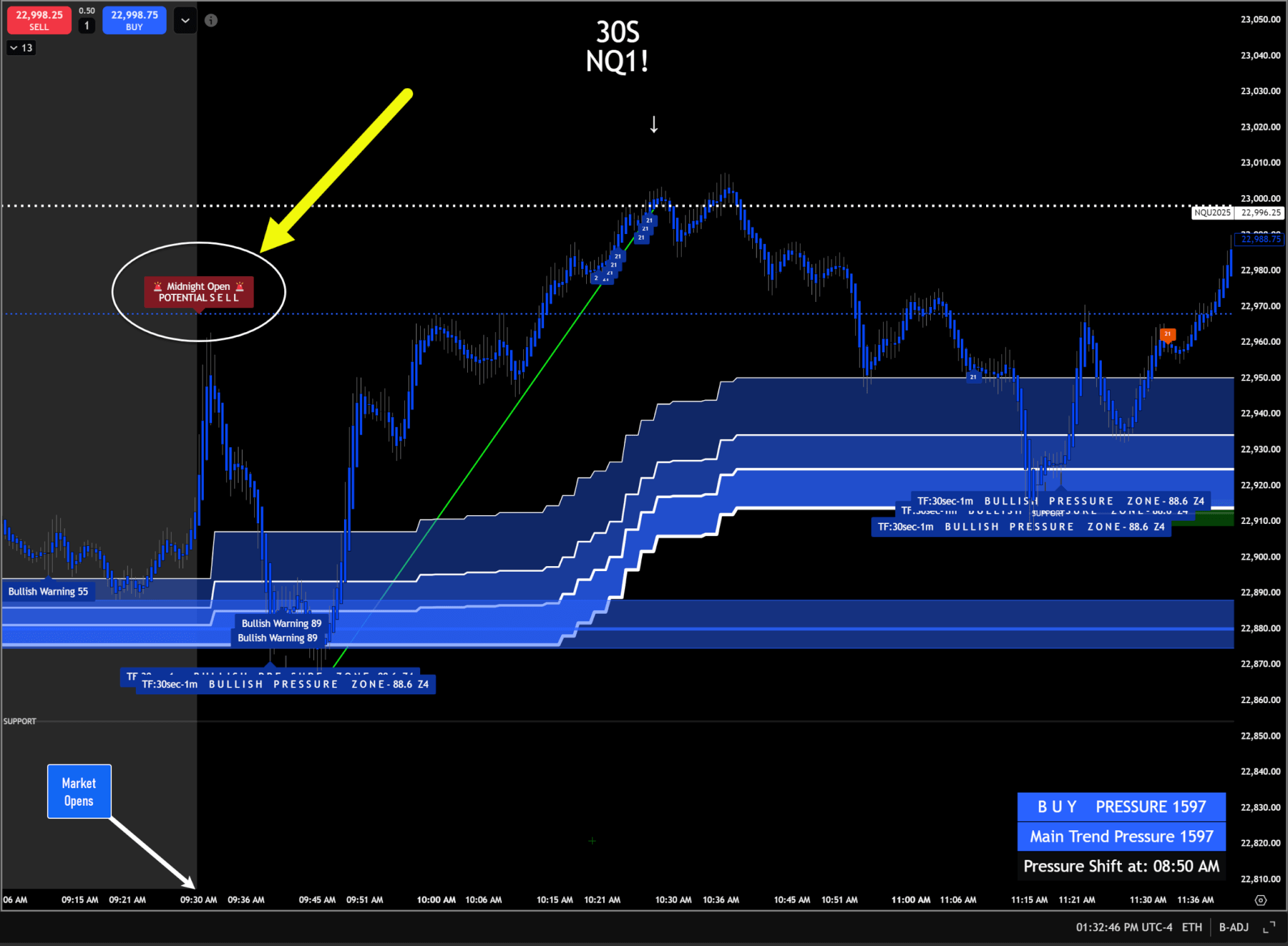

The New York Midnight Open represents the start of the new trading day on the institutional calendar (00:00 ET). It becomes a reference anchor for large traders, algo models, and volume profile algorithms.Asia–London–NY Flow

By the time the US session opens (9:30 AM ET), price has usually moved in reaction to Asia and London flows. These moves often become imbalanced. The market then uses the midnight open as a “mean reversion” or equilibrium level.Market Psychology

Retail traders often overreact at the open. Meanwhile, smart money uses key levels like Midnight Open to trap liquidity, reset direction, or test conviction.

🔹 How Reliable is it for Entries?

✅ It’s very useful, but context matters:

High Reliability when:

The Midnight Open aligns with VWAP, key Fib levels, or high-pressure zones.

Price sharply diverged overnight and US session needs rebalancing.

Price respects the level with a clean test (wick + bounce/drop).

⚠️ Lower Reliability when:

Price is consolidating with no directional conviction.

There is high-impact news (like CPI, FOMC) that causes chaotic moves.

It’s Friday (liquidity dry-up risk).

🔍 How to Use It:

Use the Midnight Open as a confluence level—not a stand-alone signal.

Wait for price to touch, reject, or flip the level during the first 30–60 min.

Combine it with:

30s or 1m SwingArm Pressure

VWAP bounce or break

High Pressure trendline breaks or candle flips

🧠 Key Insight:

When price pulls back to the NY Midnight Open and aligns with pressure, it often sets up a low-risk, high-reward trade.

Confluence matters — whether it’s a SwingArm zone, pressure trendline, or extreme Fib level, the more alignment, the higher the probability.