Visual / Color Coded Alert System, That Allows A Futures Trader To See An Upcoming“ Significant Market Move” Prior To The Event Occurring.

The blackFLAG© SwingArm & Indicator

The SwingArm was initially designed for ThinkScript/ThinkOrSwim, but after encountering numerous obstacles while attempting to integrate the pressure system, I decided reluctantly to go to TradingView. To their surprise, TradingView revolutionized the display of the pressure system and achieved the original goals set out. Although there were still some challenges, the system is now effective in enabling traders to identify pressure and act on the setups, leading to successful outcomes if the trader’s mindset is balanced and the trading plan is followed.

For retail traders who aspire to become full-time traders someday, TradingView is a crucial tool that must be in their arsenal. It is as essential as having a computer. The SwingArm High Pressure system, once learned and executed properly, will bring quick results.

Don’t miss out on the opportunity to take your trading skills to the next level!

For just $0.27 cents a day, you can gain access to the best SwingArm trading education available today and watch this informative video.

With our comprehensive training, you’ll learn how to use the powerful SwingArm Indicator to make more informed trading decisions and achieve greater financial success. Join us now and start your journey to becoming a successful trader!

Trading Links

Menu

Traders who employ technical analysis as their trading strategy invest a considerable amount of time and effort into mastering the art of chart and pattern analysis. This long-term commitment enables them to gain a true advantage in the market and contributes to their success.

Jose Azcarate, the designer of the system, emphasizes the importance of having a comprehensive understanding of various market indicators, money management, and managing psychological responses to market movements for successful trading. To simplify the analysis of these indicators, Azcarate developed the SwingArm as a visual and color-coded indicator for ThinkOrSwim. The SwingArm enables traders to locate value area zones, identify areas of interest, and make informed buying or selling decisions more easily than the traditional Volume Profile Study.

The SwingArm was developed as a result of Azcarate’s daily routine studying Fibonacci retracements and extensions and their relationship with the average true range of price. The integration of Fibonacci analysis and the appropriate ATR relationship resulted in the creation of the SwingArm, which Azcarate believes is a valuable tool for traders. He has shared it with a community of passionate traders and invested a significant amount of time teaching traders how to use the SwingArm, publishing several educational videos on their YouTube channel.

The blackFLAG© Futures Trading System is another valuable tool for traders, offering a clear trading plan that can enhance a trader’s probability of success. However, it requires discipline, patience, and effort to develop the necessary experience and skills to execute successful trades. As of February 10, 2023, the SwingArm is available for ThinkOrSwim as both a Single and Multi-Timeframe Study. Dedicated programmers have also adapted the SwingArm for use on Trading View, Ninja Trader, and Tradovate platforms.

Trading Links

Menu

Previous

Next

IMPORTANT TERMS TO KNOW ABOUT THE SWINGARM INDICATOR STUDY

BREAKUP / BREAKDOWN

The visual representation of when a trend shifts up or down.

BUY / SELL BUCKET

The SwingArm displays an actual “bucket” that indicates potential areas for backtesting following a trend reversal or break.

VALUE AREA ZONES

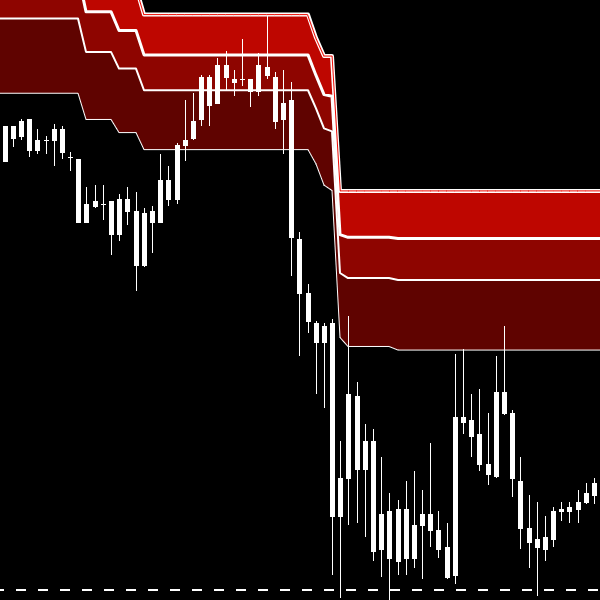

The SwingArm uses color coding to highlight value area zones, with three levels of green indicating potential buying areas and three levels of red indicating potential selling areas. These areas are recognized as having a high likelihood of significant buying or selling activity.

SLINGSHOT

The movement of price is driven by the energy generated by buyers or sellers. External factors, such as news events, can influence buying or selling behavior. The SwingArm measures the impact of these external factors, referred to as the impulse, and determines the value area zones following a trend reversal.

For instance, when the SwingArm indicates a trend reversal, the upswing will eventually come to a halt and prices will decline into the designated SwingArm bucket zones. The specific zone that the price reaches, whether it be zone 2, 3, or 4, depends on the time of day and the timeframe being considered. The lower the zone, the more significant the upward energy will be in driving prices back up. As the timeframe increases, so does the upward energy, referred to as the Slingshot effect.

NESTED SWINGARMS

When prices are trending in the same direction, multiple SwingArms can be nested within each other. For example, a bullish 10-minute SwingArm can be nested within a bullish 1-hour SwingArm. This nesting pattern can occur across multiple timeframes as long as the trend persists.

SWINGARM PAIR

SwingArms operate as a team when prices are in a trend. During such times, all SwingArms are aligned in the same direction. However, when prices are not in a significant trend, SwingArms work in pairs. The most recent large time frame to break becomes one of the pair, while the next time frame in the sequence becomes the other. For instance, in an uptrend, if the 8-hour SwingArm breaks down, its partner in the sequence is the next lower time frame, the daily SwingArm.

To effectively identify a trading range, it is advisable to use a single time frame in conjunction with multiple time frame studies applied to the same chart. Additionally, including a few multi-timeframe studies can highlight adjacent potential support and resistance levels as indicated by the value area zones.

SWINGARM SQUEEZE

A SwingArm squeeze is a situation that arises when two or more SwingArms are moving in opposite directions.

SWINGARM INTERNALS AND EXTERNALS

The SwingArm externals are designed to identify the two largest timeframes involved in a squeeze where price is moving within them. Any lower timeframes within these external timeframes become internal SwingArms. Price movement from a SwingArm squeeze occurs when two or more SwingArms are in conflict, pushing in opposite directions. As price moves from the extremes of the externals, the internal swingarms are broken on the way to backtest the active large timeframe pair. An example of this is when the price moves to Zone 4 of the 8-hour timeframe, then turns and attempts to visit the Zones of the daily chart and any lower timeframe in the range is an internal swingarm likely to break as backtesting occurs.

SWINGARM PAIRS ( Extremes or Internal timeframes )

The formation of SwingArm pairs can vary, depending on which timeframe has experienced a recent trend reversal. For instance, in an upswing, if the most recent broken SwingArm is the 30-minute chart, with the 1-hour chart offering support, then the pair would consist of these two timeframes. This creates a trading range until a subsequent break occurs. The lower timeframes within these two will become internal SwingArms and are likely to break as price seeks to retest the resistance levels in the 30-minute chart and then return to test the support of the 1-hour chart.

However, it is important to note that strong buying or selling pressures, such as those that occur during news events or session openings, can disrupt the normal behavior of a SwingArm zone.

Nested SwingArms provide powerful energy to price.

Pool Table / Trading Range and Pairs

A SwingArm visualization displays potential resistance and support levels, creating a clear depiction of price movements.

The SwingArm highlights three key zones – #2, #3, and #4, with zone 4 possessing the highest level of potential for bounce or rejection.

Price fluctuates in patterns, which can be effectively analyzed through the use of SwingArms and various timeframes. This tool provides a simple and straightforward view of price action, helping traders identify key areas of support and resistance, and allowing them to make informed trading decisions. The goal of any trader is to determine the price range and trade it effectively by moving from one zone to another.

Getting the SwingArm code

THINKORSWIM

Single and MTF SwingArms / https://tos.mx/BCbTUxO

TRADING VIEW

Available on Trading View as a Study. Search for it.

SwingArm ATR Trend Indicator by vsnfnd

NINJA TRADER

TRADOVATE

Link

Documenting your progress as you learn to trade is crucial. Whether you adopt someone else’s strategy or create your own, it’s important to keep a journal and take daily notes to reflect on your progress. Consistent review and improvement will help you avoid making the same mistakes in the future. Though it may not be an easy task, the benefits of documentation are worth the effort.

The objective of the blackFLAG Futures Trading System is straightforward: to offer a roadmap for those seeking to make a living from trading, with a particular emphasis on individuals striving for a better life for their loved ones. More significantly, the aim is to impart this knowledge to others and enable them to succeed, thereby fulfilling a Pay-It-Forward philosophy.

How Trading With blackFLAG© FTS can have a positive impact!

Easily see setups and possible opportunities including:

- Where to enter a trade

- Provides BUY/SELL Opportunities

- Provides locations to place your stop

- Provides locations to adjust your stop to and protect profits

- Provides possible take profit targets

- Provides notification of trend change

- Where to exit a trade

The blackFLAG© Futures Trading System

assists the trader with charts, trends, possible trading scenarios, advanced notice of possible moves, expected entries, trade management, and take profit targets to be considered.

To be a successful trader, it takes a combination of passion, patience, commitment, effort, constant study, and years of hard work. Success doesn't happen overnight and requires persistence, including overcoming losses through trial and error. Are you willing to invest the necessary time and effort to reach your trading goals?

Creator of the blackFLAG© Futures Trading SystemProviding a high provability trading edge to a new generation of traders.